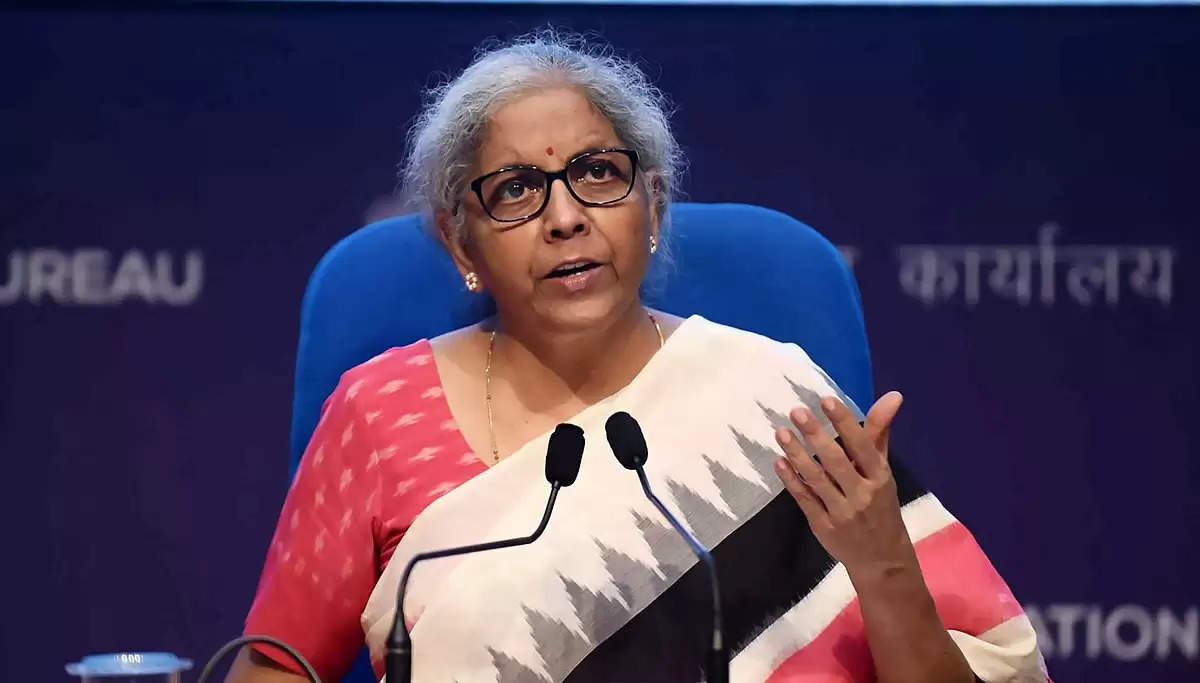

Lok Sabha approves Finance Bill 2022; FM blames rising fuel prices on Russia-Ukraine conflict

Responding to the debate on the Finance Bill, 2022, passed by the Lok Sabha on Friday, Finance Minister Nirmala Sithararaman blamed rising fuel prices on the Russia-Ukraine war and stated that the government was dedicated to decreasing the burden on the ordinary man.

Ms. Sitharaman recalled a speech by India's first Prime Minister Jawaharlal Nehru in 1951, blaming the Korean war amid soaring food prices, and late Prime Minister Indira Gandhi's decision to sharply raise income tax rates in 1970, to counter Opposition criticism of high inflation and the lack of any tax relief for the middle class in the Budget for 2022-23. Unlike many other rich countries, India had not hiked taxes to fund epidemic spending and economic recovery, she noted.

The Bill's passage, with 39 changes including clarifications on the taxation of virtual digital assets and the disallowance of cess and surcharges as a business expense, lays the door for the government to begin implementing the Union Budget provisions on April 1.

Noting that the Support Bill emphasizes how the government, led by the Prime Minister, made a "conscious decision" not to raise taxes during the pandemic or to finance its recovery. Ms. Sitharaman stated, citing an OECD analysis, that at least 32 nations, including Germany, France, the United Kingdom, Russia, and Canada, hiked various tax rates during the COVID-19 pandemic, although India did not.

"The advice I received while formulating last year's Budget and this year's Budget was that we would not go down the taxes path." As a result, this Finance Bill has been regarded as one of the dullest and most bland, having nothing outstanding about it. But it is, I believe, a Budget that does not penalize the average man while putting the money where the multiplier is greatest and there is asset development with a significant increase in spending," she remarked.

In response to MPs' criticisms concerning corporate tax cuts, Ms. Sitharaman stated that the rate cuts announced in September 2019 benefited the economy, the government, and the corporations.

"In 2018-19, our corporate tax collection was just about Rs. 6.6 lakh crore, but then COVID happened... Despite that reduction and the COVID impact, we have already collected corporate tax of Rs 7.3 lakh crore as of yesterday, so the reduction in corporate tax has rewarded us despite the intervening year being COVID-hit," she explained, adding that improved corporate health could lead to more employment.

'The government is determined to reduce the burden on the common man.'

Ms. Sitharaman responded to criticism about fuel price increases implemented since Tuesday by blaming them on the global situation resulting from the Russia-Ukraine war. "...It has nothing to do with election season." If the oil marketing corporations believe they are procuring at a higher rate on a 15-day average, we will have to endure [it]. And the crisis in Ukraine has an influence on other countries; supply networks are affected, notably for crude oil, and so on," she noted.

"In 1951, Pandit Jawaharlal Nehru could say that a Korean war would have an impact on Indian inflation... When India was not globally-connected, Korea and the United States could be cited to excuse price increases, but "if we truly today claim the Ukraine war is causing the price hike, it's not acceptable," she said, calling this a "double standard."

'Prices keep going up, food prices rise, rationing and other steps had to be taken, and you had to confront hardships,' she said, quoting Mr. Nehru's precise words from a speech. You should have complained. We live in a world where a conflict has occurred in Korea and costs of goods have risen. If something happens in the United States, it influences prices here.'

"As an administration, we passionately believed in cutting prices and easing the burden on the average man, and we have done so often." To compare what used to be and what is now, on February 28, 1970, Prime Minister Indira Gandhi, who was also Finance Minister at the time, hiked the marginal tax rate by 11 percentage points to 93.5 percent on all income over Rs 2 lakh," she noted.

"Today, if we do 1% TDS (Tax Deduction at Source), we are derided and chastised. The highest tax band for people earning more than Rs 10 lakh is now only 30%. "Taxation is an issue where the Congress party has never thought about lessening the average man's burden, whereas we are continuously working to ensure that people are not taxed and that they receive the utmost benefit," Ms. Sitharaman added.

"Business owners are viewed with pride since they produce jobs." "We don't treat them as if we had to drain everything out of them so that we can have the vicarious pleasure of murdering their entire business," she said.

Ms. Sitharaman responded to MPs' claims that the government was sending confused signals concerning the regulation of virtual digital money, saying, "There is no misleading signal." We are unequivocal. There are currently consultations underway to determine whether we should control it heavily, lightly, or completely. The matter will be made public after the consultations are completed. But, until then, we're charging it because there are a lot of transactions going on, and this is general information based on member comments."

She emphasised that the TDS provisions for virtual digital assets were not a new tax, but that they were useful for tracking purposes.

"(TDS) is one of the reasons India's tax base has grown. We had about 5-odd crore taxpayers in 2014, which has now increased to 9.1 crore because we can track the money trail of people who appear to be spending money but don't pay when they are supposed to pay taxes," the minister said, noting that this also reflects the results of the fight against black money in the economy.

The Bill was discussed by deferring the period normally allocated for private members' legislation in the House, and Ms. Sitharaman noted that this was necessary because it is the last week of March and ideally.

.png)