Today's Syrma SGS Technology BSE and NSE Listing: Time, Listing Price, Share Price, and Important Information

On Friday, Syrma SGS Technology will make its Dalal Street debut. At 10 a.m. on August 26, Syrma SGS Technology will begin trading on the National Stock Exchange (NSE) and Bombay Stock Exchange (BSE). Investors responded reasonably well to the Syrma SGS Technology IPO throughout the subscription period. The 2.85 crore shares that were up for grabs in the public offering were taken up 32.61 times over.

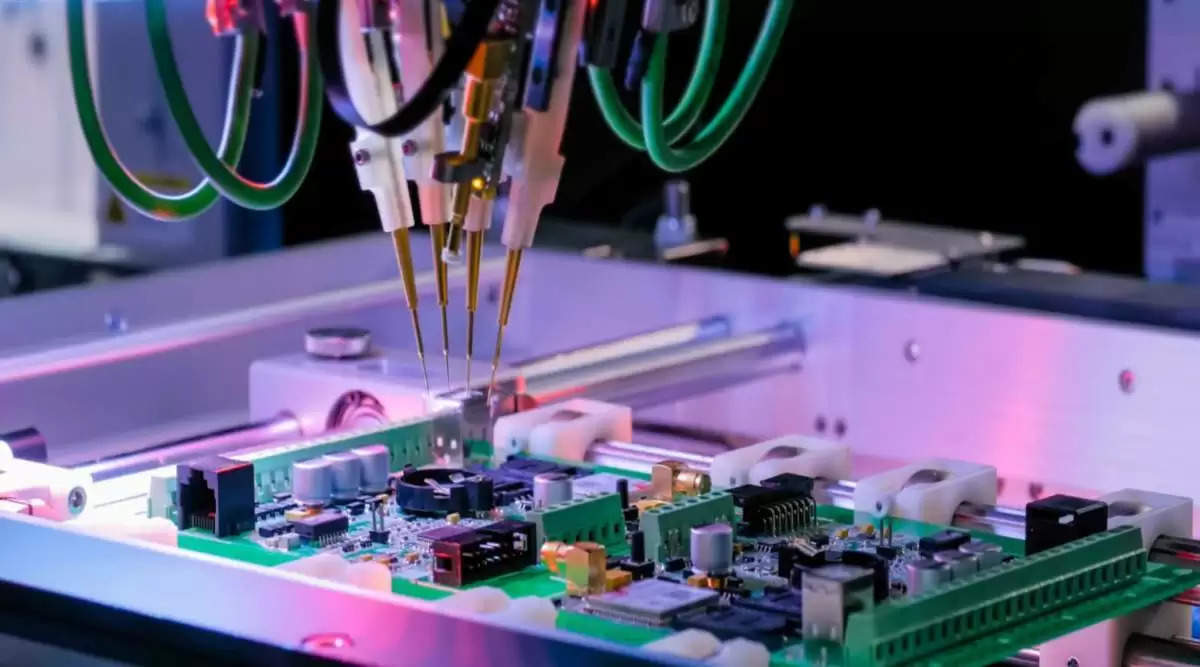

From August 12 to August 18, an electronic manufacturing services company opened its public offering. The offer's price range was set at Rs. 209–220 per share. A fresh issue of Rs 766 crore and an offer to sell 33.69 lakh equity shares were both included in the Syrma SGS Technology IPO. The company planned to raise money at the top of the price range.

According to information available with the National Stock Exchange, the Syrma SGS Technology IPO got bids for over 93.14 crore shares against the overall issue size of over 2.85 crore shares (NSE). The number of times the shares assigned to qualified institutional buyers (QIBs) were booked was 87.56. Non-institutional investors' (NIIs') reserved portions were used 17.50 times. Retail individual investors' (RIIs') designated category received 5.53 times as many subscriptions.

What to anticipate from the Syrma SGS Technology IPO listing today?

"Both institutional and retail investors participated actively in the Syrma SGS IPO. According to Narendra Solanki, head of equity research at Anand Rathi Shares and Stock Brokers, "even though the valuations were on the premium side, some listing gains could be seen based on overall investor interest shown as well as taking into account the company operates in one of the fastest growing sectors in the current market.

According to Prashanth Tapse, research analyst and senior VP of research at Mehta Equities, given the higher than anticipated investor demand, one can anticipate a listing gain of 25–30% before a recovery in secondary markets.

"We are confident about the electronics export business model, offering a complete design and production solution with a high value to well-known multinational OEMs. Regarding pricing, the issue is seeking a market cap of Rs 3,877 crore at the top price band, and based on FY21 results, the issue appears to be reasonably priced as compared to its competitors in the sector." Tapse continued, "We still feel that Syrma SGS Technology is well poised to access increasing demand for EMS products globally with heavy concentration on high-margin product range and expansion plans ahead."

IPO GMP for Syrma SGS Technology before the Listing

Prior to the offering, the grey market premium for the Syrma SGS Technology IPO increased to Rs 55. Grey market prices for Syrma SGS Technology's unlisted shares were roughly 25% higher than the IPO's maximum price band, at Rs 275 per equity share.

"The grey market premium (GMP) of the Syrma SGS Technology public offering has increased to Rs 55 from Rs 20 per equity share. The listing is anticipated to be in the Rs 260–270 range. Even at reduced IPO pricing, the issue is priced at a P/E of 50+ based on its financial information and earnings. Investors should view the market segment Syrma SGS Technology operates in from a medium- to long-term perspective, according to Manoj Dalmia, founder and director of Proficient Equities Private Limited.

.png)